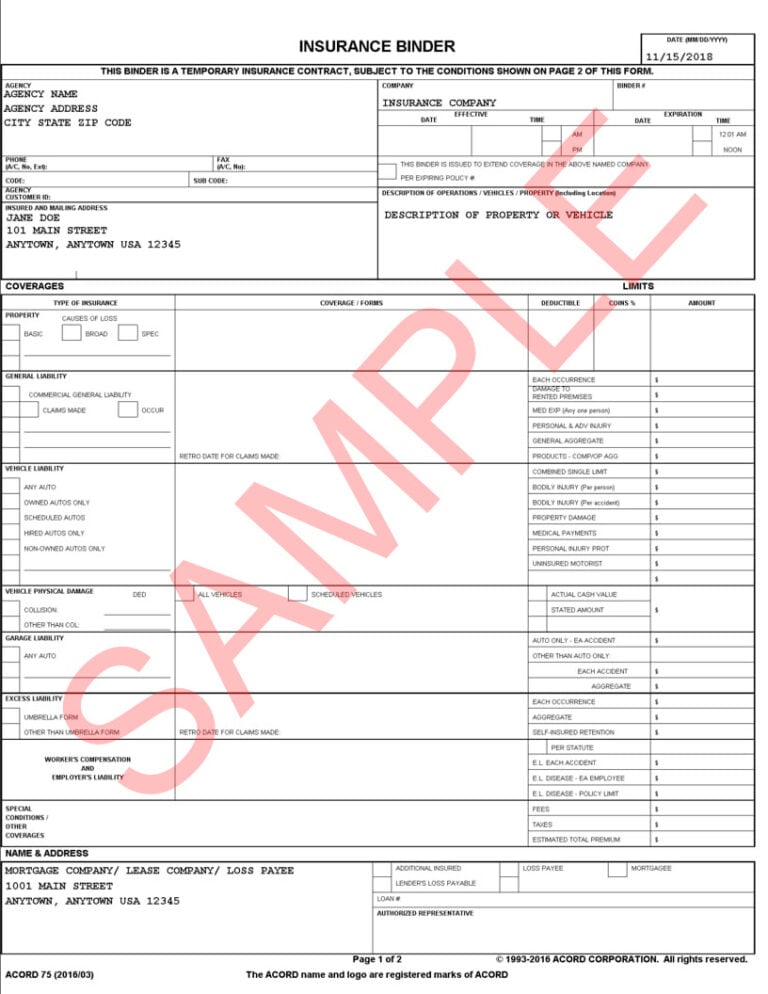

The insurance binder serves as provisional proof of insurance up to when you receive the official policy.

When you get a new homeowners policy, it usually takes a few days to underwrite the policy and process the paperwork. Moreover, mortgage lenders will typically require you to carry a homeowners policy if they are to finance your home. Your homeowners insurance policy will protect your residence as well as possessions from potential losses and damages. When buying a home, you also need to purchase a homeowners insurance policy.

Here’s detailed information on this topic. After you receive the official homeowners insurance policy, the binder becomes invalid. As such, it contains your homeowners policy details, including the deductible and coverage limits. The document essentially serves as a provisional insurance policy. A homeowners insurance binder is a document that you’ll get from your insurance agent that proves that you’ve bought homeowners insurance.

0 kommentar(er)

0 kommentar(er)